What happened to Sally Gravely’s former safe deposit box at Well Fargo’s Tanglewood branch? What was in it? Where are its contents?

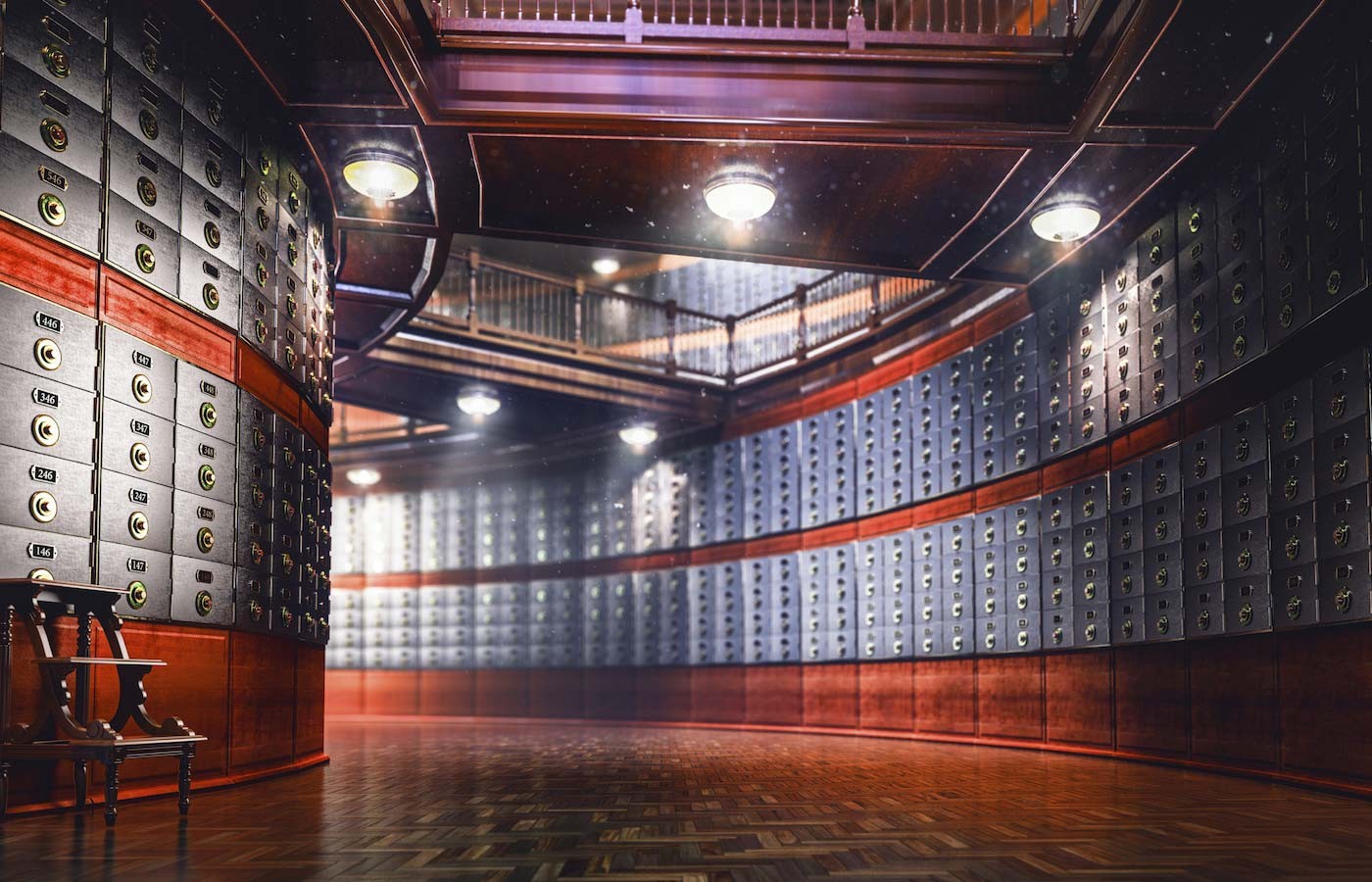

We insure assets at any bank, credit union, approved vault or depository. Peace of mind if the unthinkable happens.

Suburban family searching for answers after safe deposit box vanishes.

One expert predicts that as people return to regular life after the pandemic, some may find their safe deposit box is gone.

No safe deposit box or home safe is completely protected from theft, fire, flood or other loss or damage. Consider taking precautions…FDIC insurance covers only deposit accounts…don’t expect the bank to reimburse you for theft of or damage to the contents of your safe deposit box…Look for Insurance Coverage…FDIC Winter 2018 Newsletter

When Philip Poniz opened Box 105 at his local Wells Fargo, he discovered it was empty — and that he was totally unprotected by federal law.

A couple is accusing JPMorgan of drilling open their safe deposit boxes and selling $10 million of their jewelry after they failed to pay rent for the boxes.

$110 Million Worth of Gold Stolen from a Depository in Delaware.

Lloyd’s Insurance Denies Claims.

I am missing items from my safe deposit box. The bank has stated that it is not at fault. What can I do?

Banks use control systems to ensure that only authorized persons have access to safe deposit boxes. The goal is to allow only the safe deposit box renter to have access to and the ability to remove items from the box. A bank may defend itself against a claim of unauthorized access or missing items by showing that its controls were followed.

Wells Fargo Bank apparently doesn’t know the answers. They found the lock on Sally’s safe deposit box already had been drilled, and the box inside was empty. The bank told him there were no records.

We are changing the way people store and insure their valuables.

See what our customer's think.

Smart, Safe and Secure Protection

|

Today the storm of the century seems to occur every three months, terrorist, rioting, and looting threatens our cities and thief’s work tirelessly to steal our assets. SDBIC provides unique, specialized solutions to protect your valuable assets against these risks.

Our patented insurance provides blanket coverage for all assets stored in safe deposit boxes, safes, or vaults at financial institutions, private vaults, depositories, or other approved secured locations with limited or no disclosure of the content required at sign up. All risk coverage up to $500,000 per box can be purchased online for hard to insure assets such as gold, silver, digital currency, loose diamonds and stones, collectibles, family heirlooms and jewelry without the need for appraisals.

|

| We also provide customized insurance solutions for high-net-worth individuals, estates administrators, family offices, financial advisors, university endowment funds and other entities seeking to protect difficult to insure assets in secure locations beyond regulated financial institutions. We sell direct to consumers, through agents, financial institutions, private vaults facilities, and precious metal dealers to provide insurance solutions not otherwise available through traditional personal lines insurance companies. This is our specialty. It is all we do. We provide concierge level service to our clients, whether they are insuring $10,000. Or $60,000,000 in assets. |

Private Vaults and Depositories

Private Vaults and Depositories

• Get a policy for the amount you need.

• Have more comprehensive coverage.

• Have a policy issued in your name.

• Have a direct recovery from your carrier.

• Settle your claim in 30 days.

Art

Art

Collectibles

Collectibles

Valuables & Documents

Valuables & Documents

Coins

Coins

Precious

PreciousMetals

Diamonds, Jewelry, & Gems

Diamonds, Jewelry, & Gems