Upwards of 60% of consumers have no insurance coverage for their jewelry or collectibles.

Jewelry represents one of the most commonly stored items in a safe deposit box or private vault facility. Especially with high-value pieces or inherited collections–many of which have appreciated greatly over in the last few years–it is the smartest and most cost-efficient thing to do given infrequency of wear and continuing increase in home burglaries.

SDBIC provides a simple, convenient and cost-effective solution for those who have already made–or are willing to make–the prudent decision to use a safe deposit box at their local bank or credit union or at a SecurePlus accredited private vault facility.

You do not need to schedule or disclose the items you are placing in your safe deposit box. You also do not need appraisals for any item to obtain coverage. Once it is placed in the box, it is automatically covered subject to the limit you are carrying on the box.

By comparison, a standard homeowner’s policy provides minimal coverage for jewelry and often excludes coverage for perils such as floods, hurricanes and earthquakes. These policies also cost you far more than coverage through SDBIC [see homeowners cart below].

SDBIC’s coverage offered in partnership with AXA ART, the only art and collectibles insurance specialist in the world, with unrivaled knowledge and expertise in the use, display and storage of high-value collectibles, such as jewelry. Following a loss our unique relationship with AXA ART allows you, to access our network of national experts who specialize in repairing or restoring jewelry items, or you may choose a jeweler of your choice. Read more here.

A Safe Deposit Box or Vault Facility + SDBIC = The Ultimate Safe-Haven for Your Jewelry

The SDBIC Solution

Blanket insurance from $5k–$500k is available for your jewelry while stored in a safe deposit box or SecurePlus private vault facility. There is no need to provide a schedule of items or appraisals at purchase.

The policy will cover your jewelry plus any other property you elect to keep in the box or vault, including previously uninsurable items such as cash, currency, titles, deeds and even certifications and appraisals if destroyed.

Protection is provided against natural disasters and catastrophes including: floods, hurricanes, earthquakes and terrorist attacks which are excluded on many policies.

The purchase process is simple, fast and fully transparent. You choose the coverage limit needed, and pay the corresponding annual premium. If you add items you can simply increase the limits on your policy. All of this can be done online or via phone–and in less than 5 minutes.

All legal property that fits inside your box or vault, including…

- Gold

- Currency

- Bonds

- Collectibles

- Art

- Coins

- Stamps

- Antiques

- Jewelry

- Diamonds & Gems

- Photos

- Digital Backups

- Important papers such as wills, trusts and passports

- And more…

Property inside your box or vault is insured against loss, damage or destruction caused by…

- Fire

- Flood

- Robbery

- Burglary

- Hurricane

- Tornado

- Landslide

- Mudslide

- Earthquake

- Volcano

- Avalanche

- Explosion

- Terrorist Act

- And more…

Homeowners Cost & Coverage Comparison

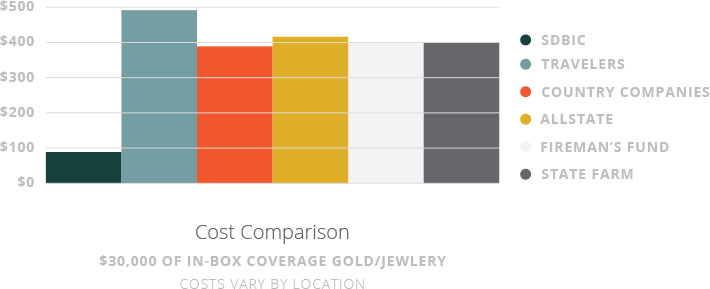

You do the math: SDBIC’s insurance covers far more and costs significantly less than any comparable homeowners’ policy you can find in the market today. Insuring valuables under your homeowner’s policy requires full disclosure of the items, as well as costly, inconvenient appraisals, and upon a loss you also pay a deductible.

Plus, whether your valuables are kept at home or stored in a safe deposit box, homeowners oftentimes does not provide the full protection one assumes. For example, off-premise flooding is not covered with many homeowners’ policies.

With SDBIC there are NO disclosures, appraisals or deductibles. SDBIC also covers damage due to flooding.