72% of art professionals say that fine art insurance is very important to have.

Insure your valuable art and store those pieces not being displayed at a qualified, risk assessed vault or storage facility with blanket policies up to $500,000 that require no scheduling, appraisals or deductibles.

We provide the industry’s most convenient and cost-effective solution for those who are storing their collections at an approved storage facility. You can rotate pieces from your collection in and out of storage without having to notify us, and sign-up online in a 5 minute transaction or by contacting our customer service department at 224-227 6181.

For those looking to insure your entire collection, we can assist you developing a program to fit your unique needs. Coverage for private collections up to $1M and more is available. Whether it is worldwide coverage, agreed value, current market value, scheduled or blanket coverage, deductible or no deductible; we will work with you to tailor an insurance solution to meet your needs and budget.

SDBIC’s coverage is offered in partnership with AXA XL, a division of AXA one of the largest insurance companies in the world. As a result of this relationship we offer an unparalleled understanding of the risks involved with art storage and protection. From underwriters to claims specialists, our teams possess the highest level of training and knowledge in your unique, niche area.

How simple is the SDBIC sign-up process

We are happy to work with other agents or brokers. We offer a competitive commission structure with no minimums. Please contact us at 224-227 6181.

All legal property that fits inside your box or vault, including…

- Gold

- Currency

- Bonds

- Collectibles

- Art

- Coins

- Stamps

- Antiques

- Jewelry

- Diamonds & Gems

- Photos

- Digital Backups

- Important papers such as wills, trusts and passports

- And more…

Property inside your box or vault is insured against loss, damage or destruction caused by…

- Fire

- Flood

- Robbery

- Burglary

- Hurricane

- Tornado

- Landslide

- Mudslide

- Earthquake

- Volcano

- Avalanche

- Explosion

- Terrorist Act

- And more…

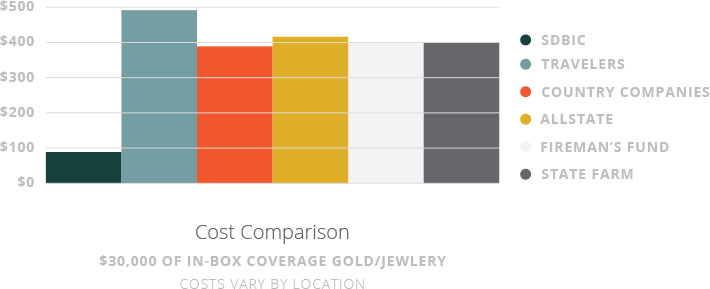

Homeowners Cost & Coverage Comparison

You do the math: SDBIC’s insurance covers far more and costs significantly less than any comparable homeowners’ policy you can find in the market today. Insuring valuables under your homeowner’s policy requires full disclosure of the items, as well as costly, inconvenient appraisals, and upon a loss you also pay a deductible.

Plus, whether your valuables are kept at home or stored in a safe deposit box, homeowners oftentimes does not provide the full protection one assumes. For example, off-premise flooding is not covered with many homeowners’ policies.

With SDBIC there are NO disclosures, appraisals or deductibles. SDBIC also covers damage due to flooding.