Collectibles

Protect what you collect. Whether a serious investor or the casual collector who has inherited property, protecting and insuring your items can be a confusing task–where even the most basic of questions and concerns become daunting:

- What items are covered by my homeowners or renters insurance and which risks am I protected against?

- Do I need an appraisal for some or all of my collection, and what if I add pieces to my collection or items increase in value?

- What if I have several collections–will my insurance pay if items are damaged or destroyed?

SDBIC provides a convenient and cost-effective solution for collectors who have made, or are willing to make the prudent decision to store their collection in a safe deposit box or vault at a financial institution or a SecurePlus accredited private vault facility.

SDBIC’s coverage offered in partnership with AXA XL, the art and collectibles insurance specialist with unrivaled knowledge and expertise in the use, display and storage of high-value collectibles.

Following a loss, we have the artisans and experts throughout the country that can provide the services to repair or restore your valuable collection.

The maximum protection offered by a safe deposit box along with SDBIC’s insurance creates the ultimate safe haven for your collectibles.

The SDBIC Solution

We provide blanket insurance from $5K to $500K and above for your entire collection. A schedule of items or appraisals is not required at purchase when the total value being insured is $500,000 or less.

The policy covers any property you keep in the box, including previously uninsurable items such as: cash, currency, titles, deeds even certifications and appraisals if destroyed. Protection is provided against floods, hurricanes and earthquakes which are excluded on many policies.

The purchase process is simple, fast and fully transparent. You choose the coverage limit needed, and pay the corresponding annual premium. If you add to your collection or add additional unrelated property to your box, you can increase the limits on your blanket policy. The purchase and management of your insurance can be done online or by calling us at 224-227 6181. It takes less than 5 minutes in either case.

All legal property inside your box or vault, including…

- Gold

- Currency

- Bonds

- Collectibles

- Art

- Coins

- Watches

- Stamps

- Antiques

- Jewelry

- Diamonds & Gems

- Photos

- Digital Backups

- Important papers such as wills, trusts and passports

- And more…

Property inside your box or vault is insured against loss, damage or destruction caused by…

- Fire

- Flood

- Robbery

- Burglary

- Hurricane

- Tornado

- Landslide

- Mudslide

- Earthquake

- Volcano

- Avalanche

- Explosion

- Terrorist Act

- And more…

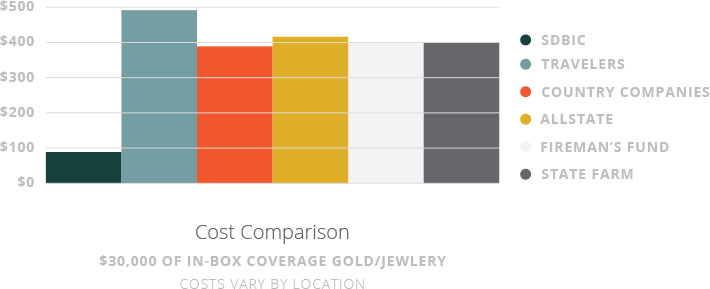

Homeowners Cost & Coverage Comparison

You do the math: SDBIC’s insurance covers far more and costs significantly less than any comparable homeowners’ policy you can find in the market today. Insuring valuables under your homeowner’s policy requires full disclosure of the items, as well as costly, inconvenient appraisals, and upon a loss you may also pay a deductible.

Plus, whether your valuables are kept at home or stored in a safe deposit box, homeowners policies often do not provide the full protection one assumes. For example, off-premise flooding or loss resulting from earthquakes is often not covered with many homeowners’ policies.

With SDBIC there are no disclosures, appraisals or deductibles at signup, which can be done on line in less than 5 minutes.