Precious Metals

Invest and protect. Whether you are a first time buyer of bullion, or accumulating precious metals as part of a longer-term investment strategy; we uniquely understand the important decisions you need to make regarding where, when and how to best protect your purchase. It’s why we developed–and patented–the first and only insurance solution perfectly suited for your needs.

Safe Storage vs Home Storage

We understand why you may decide to take home delivery of your purchase–what is more gratifying and fulfilling than seeing and touching what you worked so hard to obtain. But year over year the same story line persists: Receiving shipments of gold or silver at your home makes you more vulnerable to burglary; and the chance of recovering stolen property is dismal. Sadly, FBI crime report statistics show that 93% of stolen items are never recovered.

So take home delivery, but make certain to store your investment off-site–in a safe deposit box at a local bank, credit union or at private vault facility–and then insure your purchase. In addition to the peace of mind that comes with a safe deposit box, you now finally have easy access to blanket coverage for the entire contents of a safe deposit box. SDBIC is the most comprehensive and cost-efficient insurance in the market. There are no disclosures, appraisals or deductibles.

Local Storage vs Depository Storage

You no longer need to have your purchases shipped to a remote depository and rely on a piece of paper to confirm what you own.

SDBIC provides you with the ability to conveniently and affordably insure your assets against theft, natural disasters and catastrophes, while still being able to physically inspect, verify, touch and hold them.

It all starts with you making the prudent decision to store your assets in what is universally recommended as the securest place–a safe deposit box at your local bank or credit union or at one of our growing network of SecurePlus accredited private vault facilities. You then just conveniently sign-up for insurance from SDBIC in a 5-min online process that does not require disclosure or appraisal of the items you are storing.

The Result?

You now have a policy issued directly in your name insuring the precise value of your holdings. And your property is held in a segregated unit, not with other similar type assets as typically done at a depository. Perhaps most important, the combined cost of the rental fee and insurance is significantly less than what you would pay at any depository.

Using a Self-Directed IRA to Purchase Qualified Precious Metals?

You are not required to use the dealer-sponsored depository. A SecurePlus accredited private vault facility close to your residence is a local, acceptable option– and your local bank or credit union may also be an option to accommodate direct delivery and storage.

Combined with an SDBIC insurance policy, either of these options will offer you greater coverage at a lower cost–and keeps the items close to home. SDBIC can even help coordinate the process with your IRA Administrator and the storage facility.

The SDBIC Solution

Blanket insurance from $5k to $500k and above is available for your investment while stored in a safe deposit box or a SecurePlus accredited vault. There is no need to provide a schedule of items or appraisals at purchase.

The policy will cover your precious metal investment plus any other property you elect to keep in the vault or box, including previously uninsurable items such as cash, currency, titles, deeds and even certifications and appraisals if destroyed.

Protection is provided against theft, natural disasters and catastrophes including floods, hurricanes, earthquakes and terrorist attacks which are excluded on many policies.

The purchase process is simple, fast and fully transparent. You choose the coverage limit needed, and pay the corresponding annual premium. If you add items you can simply increase the limits on your policy. All of this can be done online or via phone–and in less than 5 minutes.

All legal property that fits inside your box or vault, including…

- Gold

- Currency

- Bonds

- Collectibles

- Art

- Coins

- Stamps

- Antiques

- Jewelry

- Diamonds & Gems

- Photos

- Digital Backups

- Important papers such as wills, trusts and passports

- And more…

Property inside your box or vault is insured against loss, damage or destruction caused by…

- Fire

- Flood

- Robbery

- Burglary

- Hurricane

- Tornado

- Landslide

- Mudslide

- Earthquake

- Volcano

- Avalanche

- Explosion

- Terrorist Act

- And more…

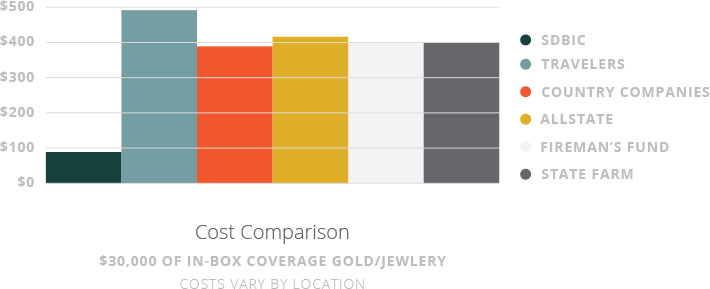

Homeowners Cost & Coverage Comparison

You do the math: SDBIC’s insurance covers far more and costs significantly less than any comparable homeowners’ policy you can find in the market today. Insuring valuables under your homeowner’s policy requires full disclosure of the items, as well as costly, inconvenient appraisals, and upon a loss you also pay a deductible.

Plus, whether your valuables are kept at home or stored in a safe deposit box, homeowners oftentimes does not provide the full protection one assumes. For example, off-premise flooding is not covered with many homeowners’ policies.

With SDBIC there are NO disclosures, appraisals or deductibles. SDBIC also covers damage due to flooding.